The Culver City Rental Registry and Prop 13

The Culver City Rental Registry is collected by the City of Culver City directly from landlords. It has been made available via public records request to https://www.ccrentals.org.

Previously on this site we’ve established, using Padmapper and Craigslist ads, that Prop 13 is not passed on to renters. A common retort has been “of course landlords won’t pass on saving to new tenants, but long-time renters get lower rents because of Prop 13”. That sounds fair, but now that we have data we can see it’s likely not true.

The Data

Currently the Rental Registry has 62,227 datapoints specifying, among other things, the address, report date, and rent amount. Given the address, we can pull AIN and property tax information from the LA Country Assessor web portal. The county give us more information: Base Year (the year the property last was sold), Base Year Property Tax, Current Year Property Tax, Use Type (whether it’s a SFH, condo, etc.), and square footage.

| UseType | count |

|---|---|

| Multi-Family Residence | 23704 |

| Condominium | 7003 |

| Single Family Residence | 4864 |

| Vacant Land | 554 |

| Commercial | 448 |

| Other Property Type | 2 |

Most of the data is from apartment buildings which, unfortunately, don’t have precise tax information available online. “Vacant Land”, “Commercial”, and “Other” are uninteresting to us so we restrict our attention to condominiums and single family homes. For each of these we drop reports when the report date precessed the Base Year (because that means the owner in the assessor database is different from the landlord who reported the rent to Culver City) as well as rows that contain NaNs, zero rents, impossibly high rents, or null sqft. This leaves us with 3,334 rent reports across 1,023 distinct addresses in Culver City.

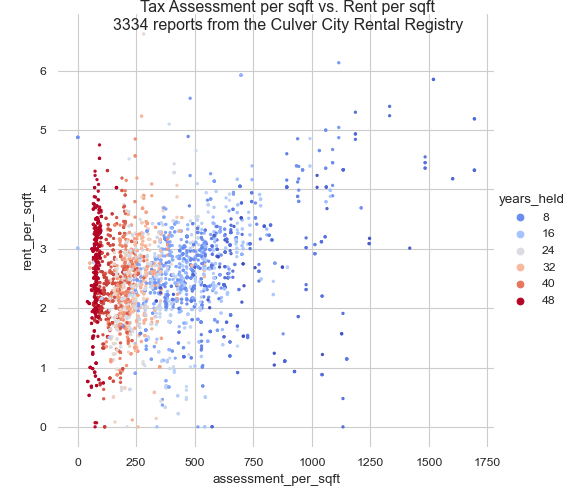

Here’s the plot of how tax assessments and rent correlate:

Howard Jarvis and his supporters claimed that when tax assessments are low then rent will drop accordingly. And while there does seem to be some degree of truth to this, it’s only for newly purchased units (the blue dots). These units have not been held long enough to feel much effect from Prop 13 and the assessments closely track current market value.

What’s interesting to look at is the red dots. These units have been held for a long time and thus have remarkably low assessments due to Prop 13. The rent_per_sqft on these is easily as high as for newly-purchased units and there’s no evidence that the landlords have been giving their tenants a discount simply because of their low property tax rates.

So again we see that Prop 13 is not incident on renters. Rent is set by what the market will bear, not what taxes the most fortunate landlords pay.