Prop 13 Is Not Passed On to Renters

California’s Proposition 13 is often advertised to renters as a way to keep rents low. The pitch is that landlords are nice and, when given tax cuts, will pass the savings on to their tenants. This promise was even made explicitly during the initial campaign in the 70s:

That was pretty obviously a lie. And of course shortly after Prop 13 passed rents didn’t go down and tenants lashed out with aggressive rent control laws in response. But, despite all that, people today still believe that Prop 13 is keeping rents lower than they would be without it.

Here is some data which suggests otherwise.

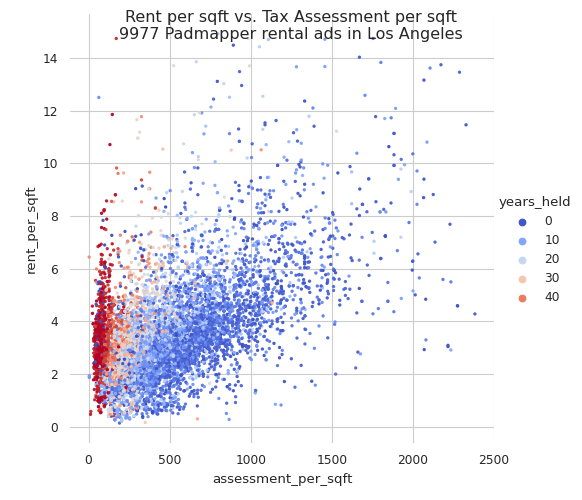

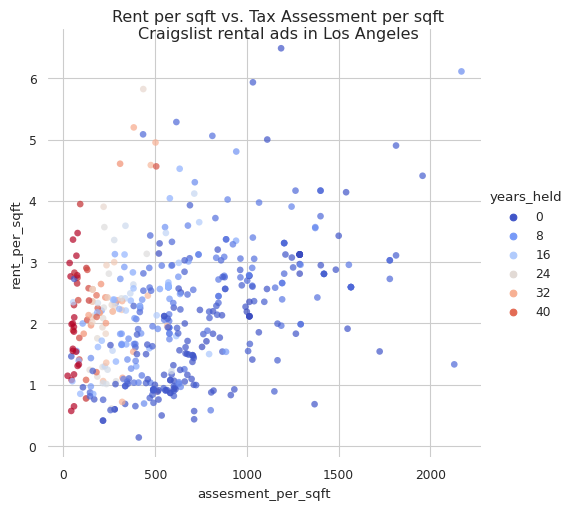

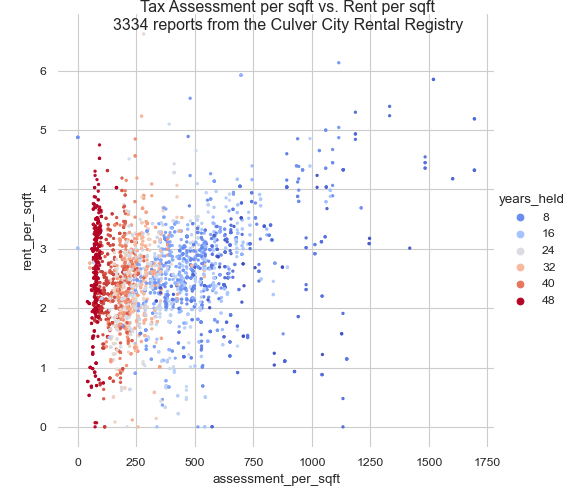

To investigate the relationship between property tax assessments and rent I collected ads from Padmapper, Craigslist and, recently, the Culver City Rental Registry. These ads include advertised rent, square footage, and exact addresses. I restricted data collection to single-family homes because tax assessments for apartment buildings often do not resolve to individual units.

To get tax information I used the LA County Assessor Portal which provides up-to-date information on property taxes and assessments. The Portal also provides the “base year” which is the year the property last changed ownership. Since the passage of Prop 13 property assessments are made based on the value of the property during the “base year”.

The final result is a dataset that has advertised rent, square footage, and property tax assessment for each address.

The below plot shows rent against tax assessment per sqft:

Here’s the same study but using Craigslist rental ads instead:

And here’s the study but using the Culver City Rental Registry:

Howard Jarvis promised that if assessment_per_sqft decreased then rent_per_sqft would also decrease. He was lying.

Contrary to the claims of Proposition 13 supporters, there is no clear relation between tax assessments and rent prices. Yes the data shows that higher assessed properties might command higher rents, but this is only true for recent purchases (blue dots). Long-held homes (red dots) with low tax assessments charge comparable rents to recently-purchased homes with higher tax assessments.

To put it another way: Prop 13 is not incident on renters – a statement in line with mountains of academic research.

A map to look at data points individually

A concrete example

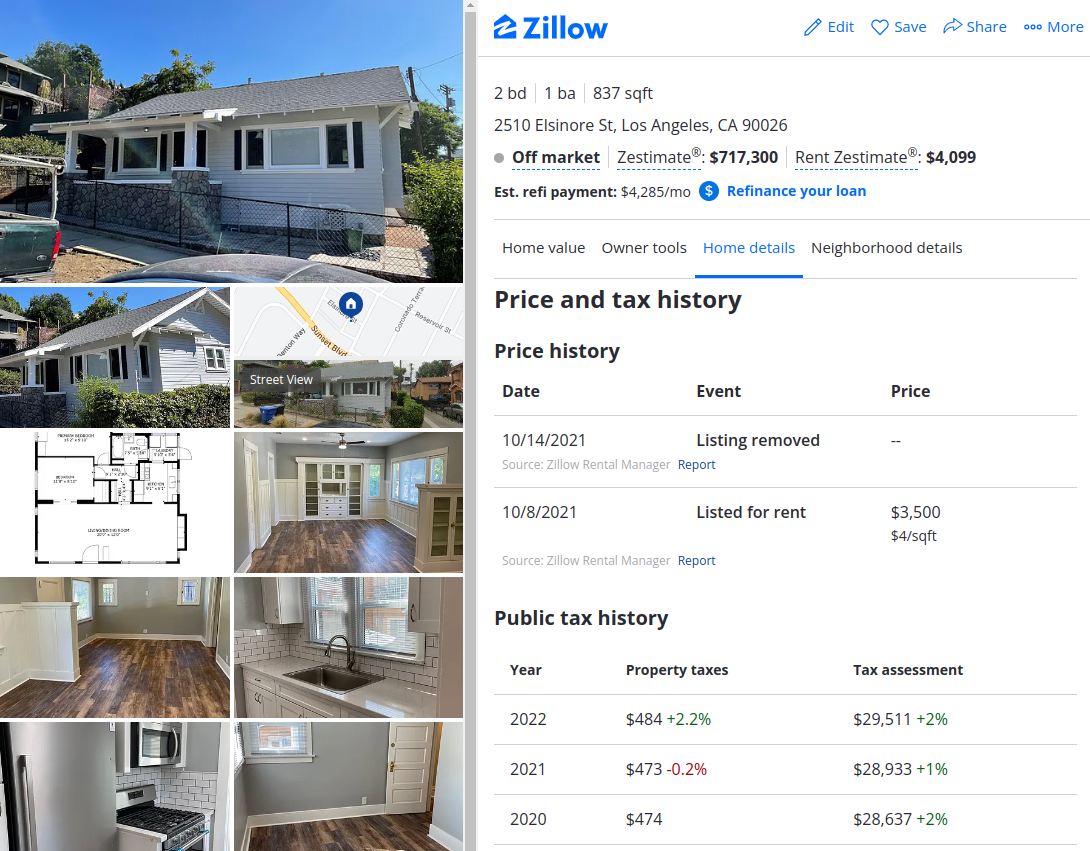

Here is a long-held 837 sqft house in Silverlake. Rent is $3500 per month. The owner pays $484 per year in property taxes on a $29,511 assessment. From the tax assessor’s point of view, if you rent this house in January you will have paid off more than it’s complete value before Halloween.

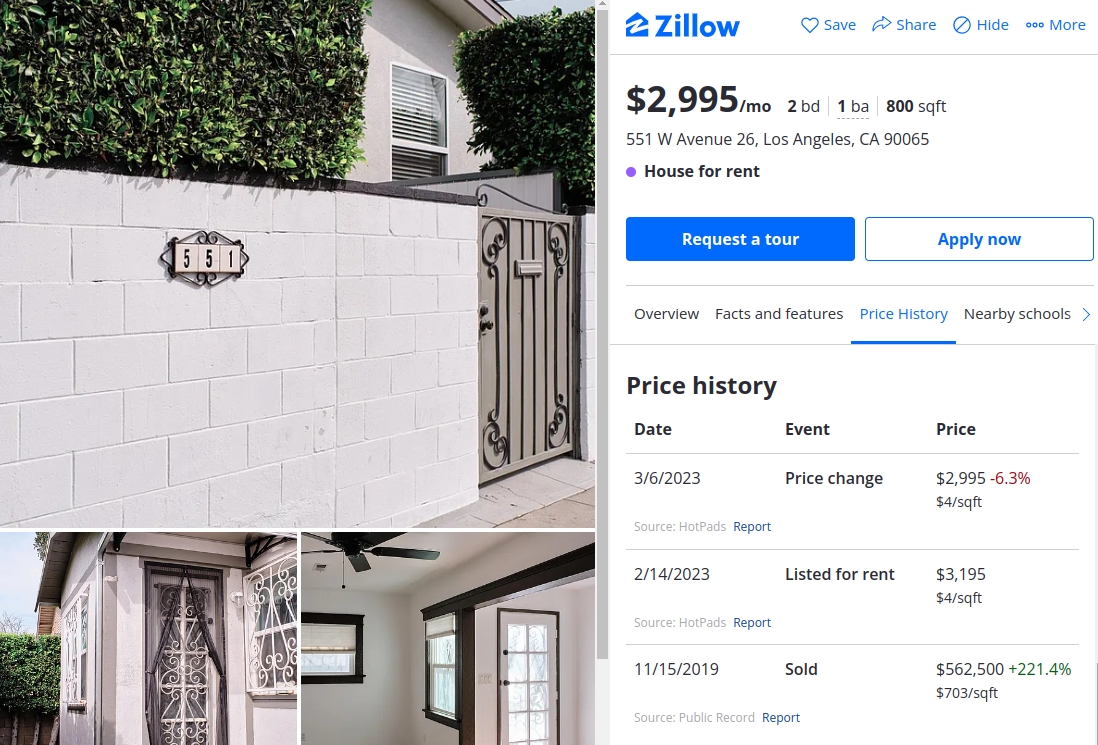

Now, just 3.5 miles away, is a more recently purchased house of the same size with the same number of bedrooms. It’s currently up for rent at $2,995 and the tax assessment is $579,693 (more than 10x the previous home). The rent, however, is about the same at roughly $4/sqft.

Discussion

As rent and home prices soar, landlords enjoy a decline in their effective tax rates and a widening of their profit margins. Meanwhile, tenants are burdened with the necessity of spending more to maintain their residences, while also facing the need to save up for the ever-more-distant day when they might buy a home of their own. And if they do, they will be confronted with an onerous tax burden, often as much as ten times greater than that which the previous owner paid.

It doesn’t matter whether a landlord is new to the scene or an entrenched member of the establishment. Both will charge as much as they can, regardless of their tax rate. Rent, as all market-driven commodities, finds its equilibrium through supply and demand. The notion that landlords would somehow be compelled to pass on their tax savings to their tenants is utter nonsense.